Imagine that you’re closing a deal, whether you’re the dealer or customer. Financing is approved, it’s time to finish up the application – and the lender asks for proof of income.

So obviously the customer now has to search for a paystub or the dealer has to worry about losing the deal, right? Nope. Roadrunner Financial’s Instant Proof of Income Report allows customers to share proof of income directly from their smartphone, without leaving the shop.

Here’s How it Works

The Instant Proof of Income Report is powered by The Closing Docs.

To get started with the Instant Proof of Income Report, dealers first have to sign up through Roadrunner Financial. If you’re interested in utilizing this feature, sign up now! Once it’s enabled, the process is simple.

Dealer: Send a Link

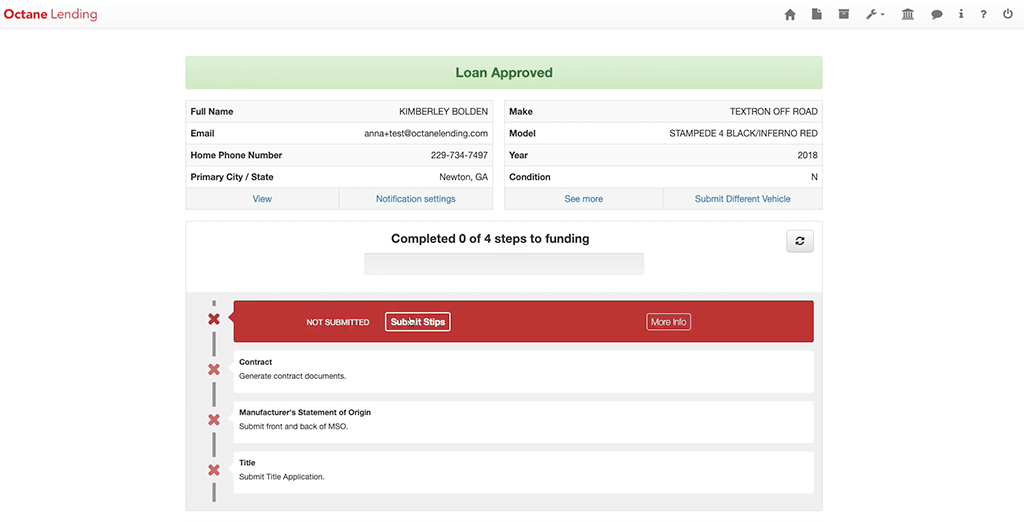

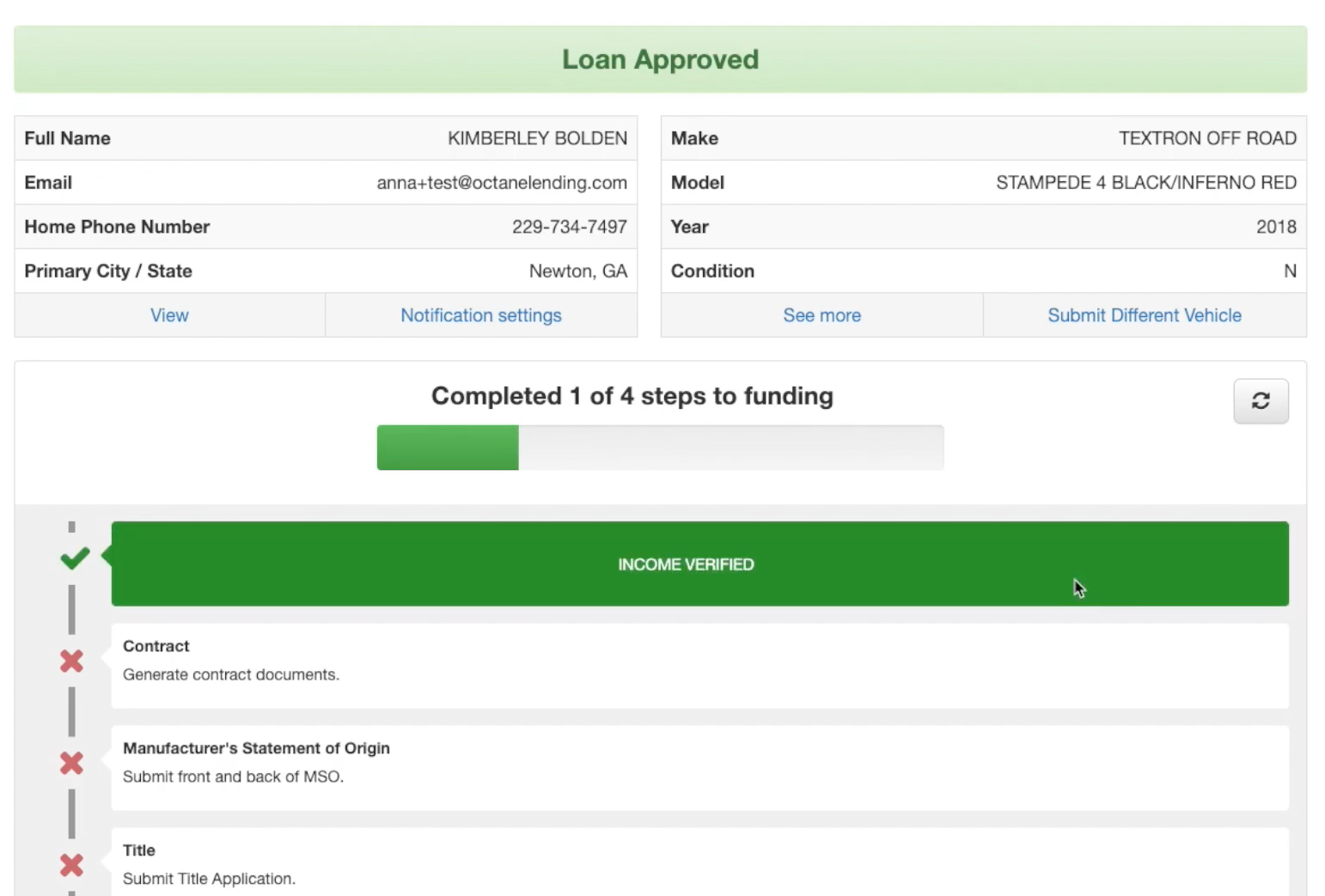

When you have a Roadrunner Financial approval that requires income verification, Proof of Income will appear in the dealer funding checklist. Click “Submit Stips” in the checklist.

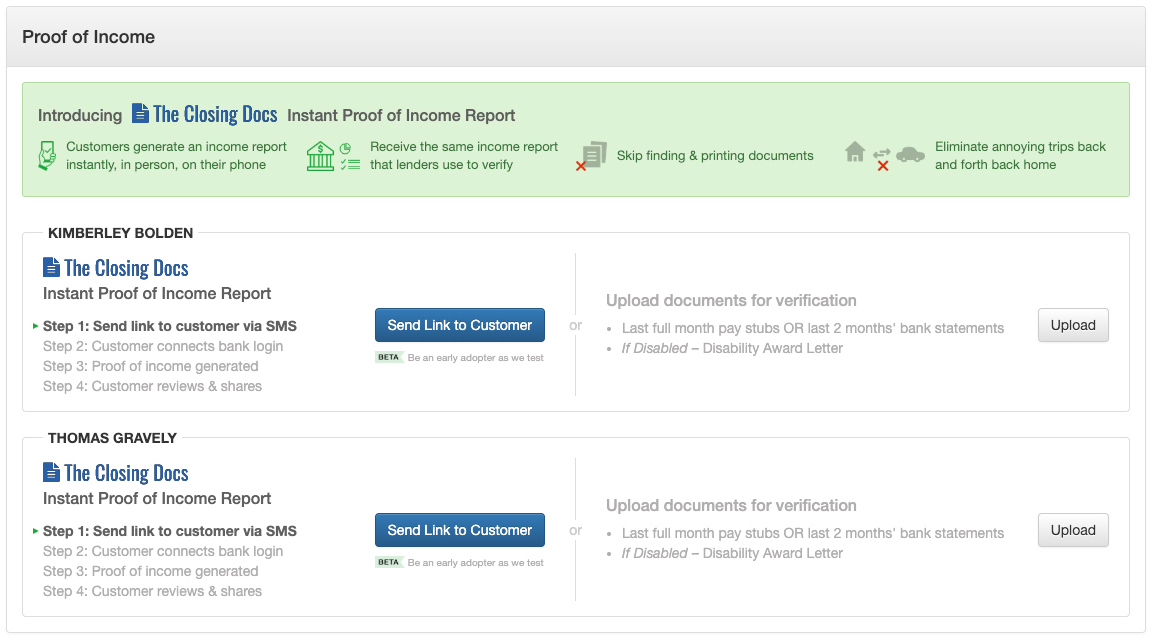

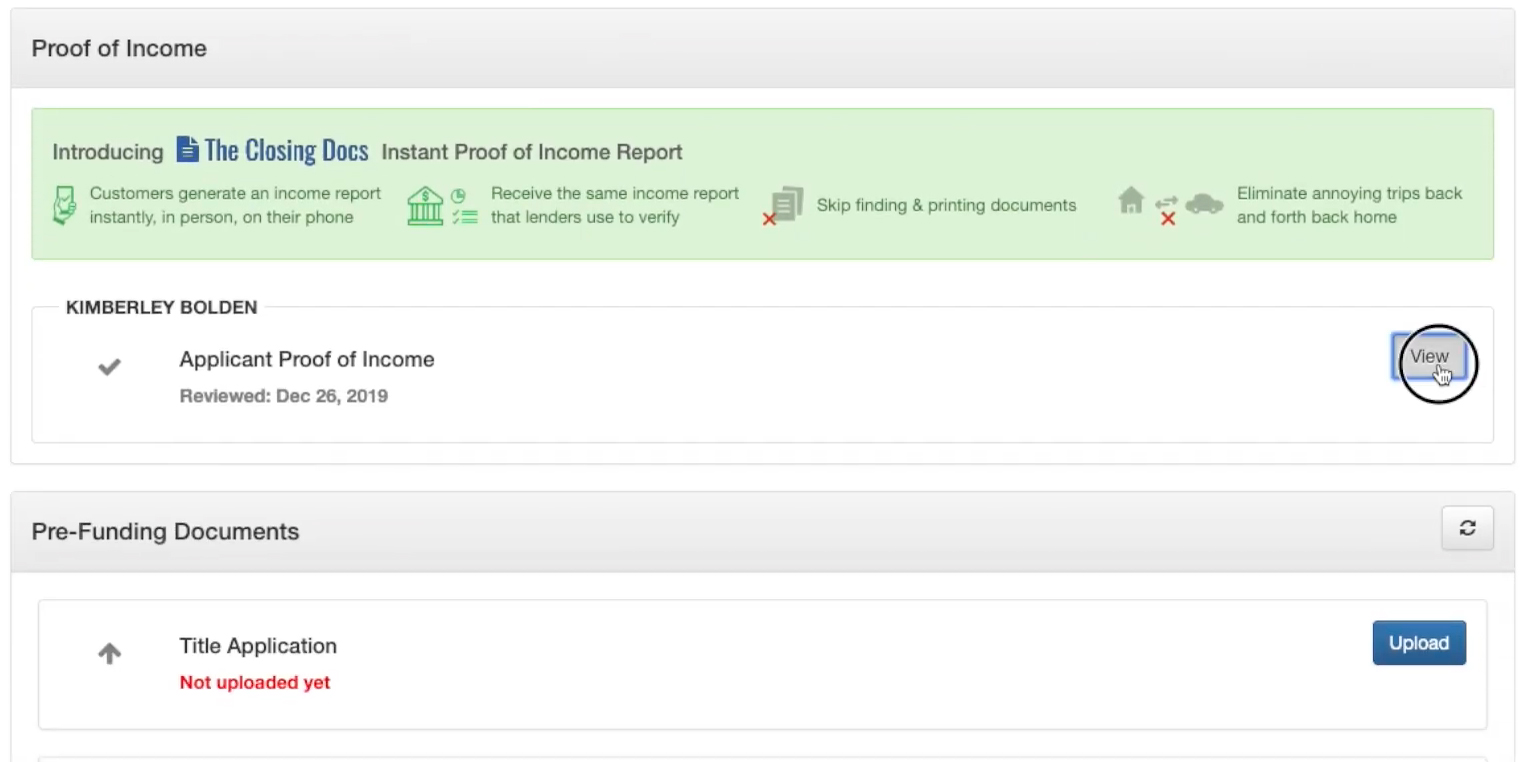

You’ll be directed to the Proof of Income section. From here you can send a text message to the customer, to send proof of income from their phone. Hit “Send Link to Customer”.

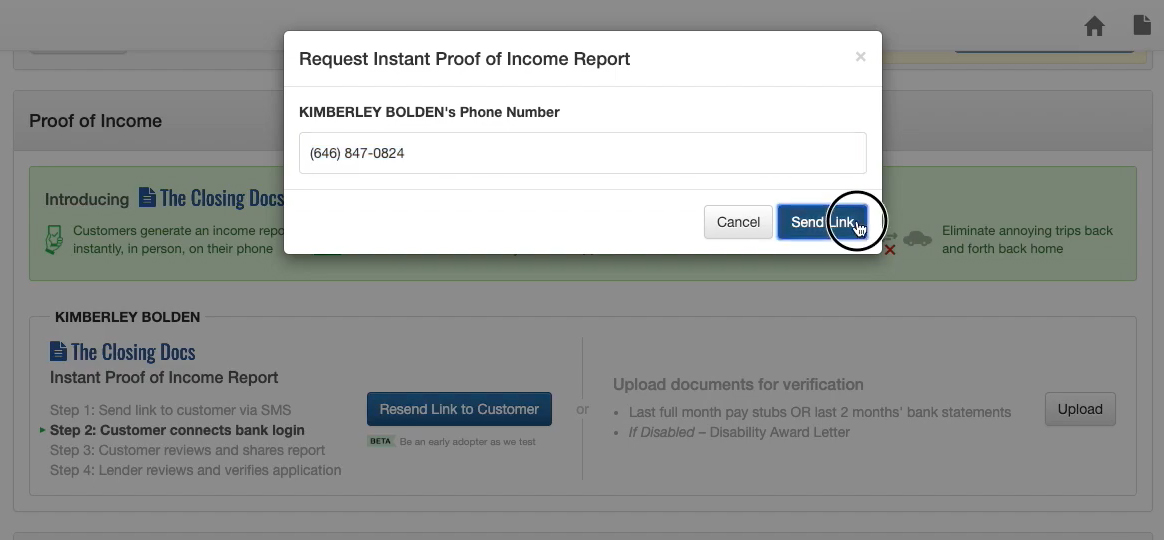

Once the number is verified, hit “Send Link” to send the message.

Customer: Connect to Bank

The entered customer phone number will get a message with a link.

Once the link is clicked, you’ll be taken to The Closing Docs, which powers the Instant Proof of Income Report. Here, you can start the process of generating an income report. There are 3 customer steps:

1. Collect

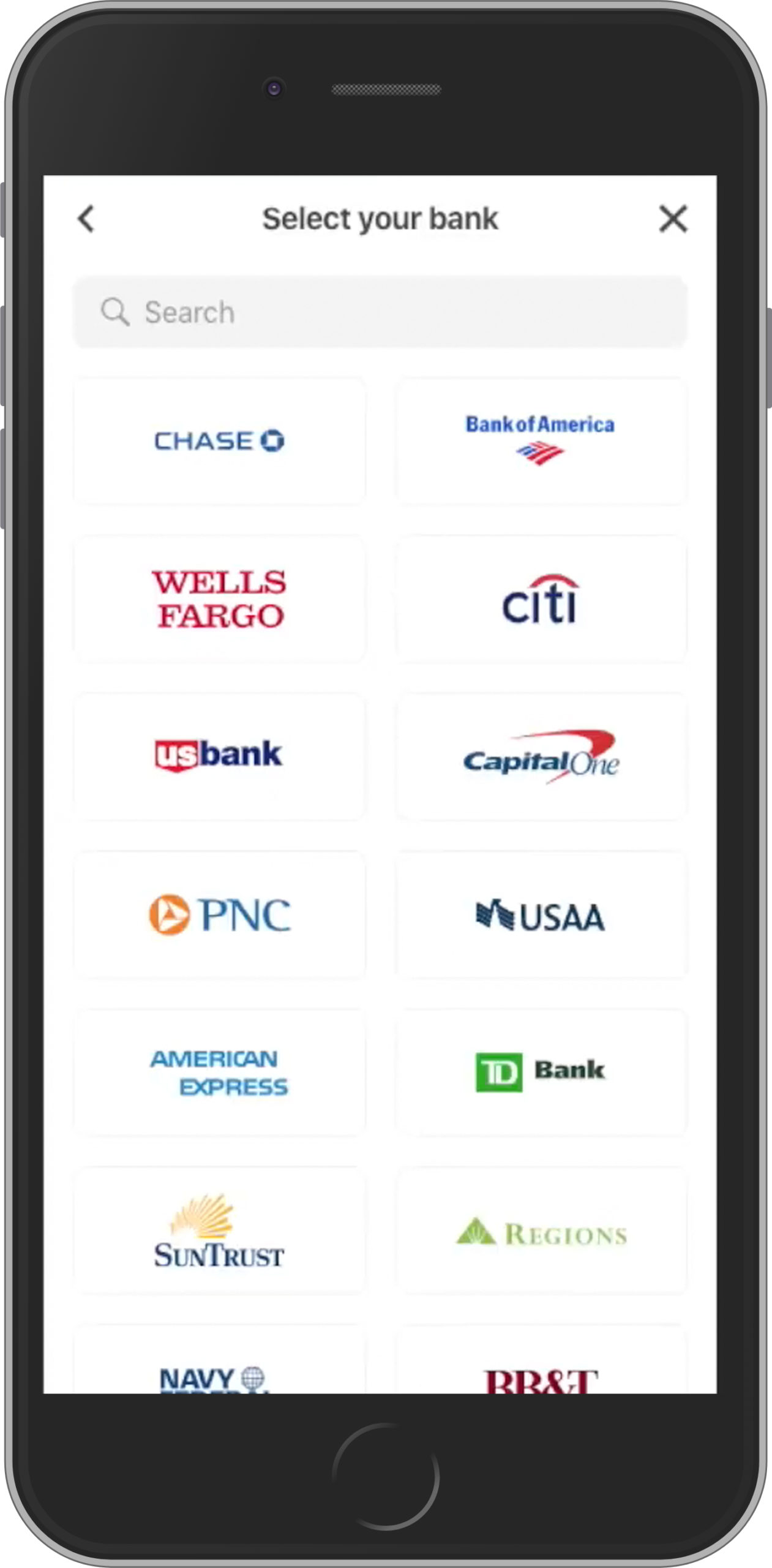

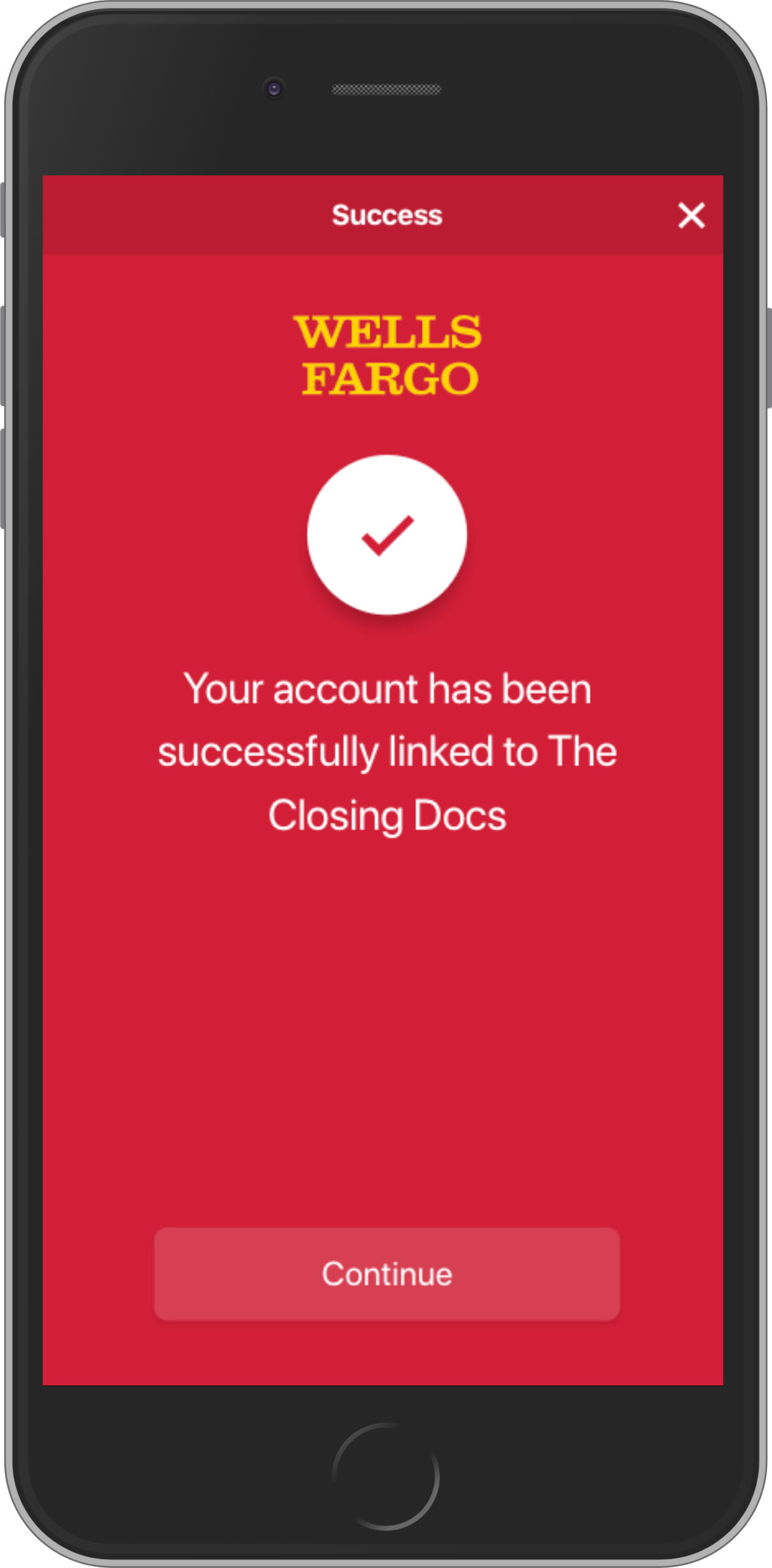

The customer applying for financing needs to sign into their bank. Select from the list or search for the bank from the selections (most banks are represented) and sign in with online banking credentials.

By signing in, the The Closing Docs is securely connected to the bank account. Roadrunner Financial does not get access to this bank account.

Once The Closing Docs successfully connects to your bank account, an income report is generated. The Closing Docs then disconnects from the account.

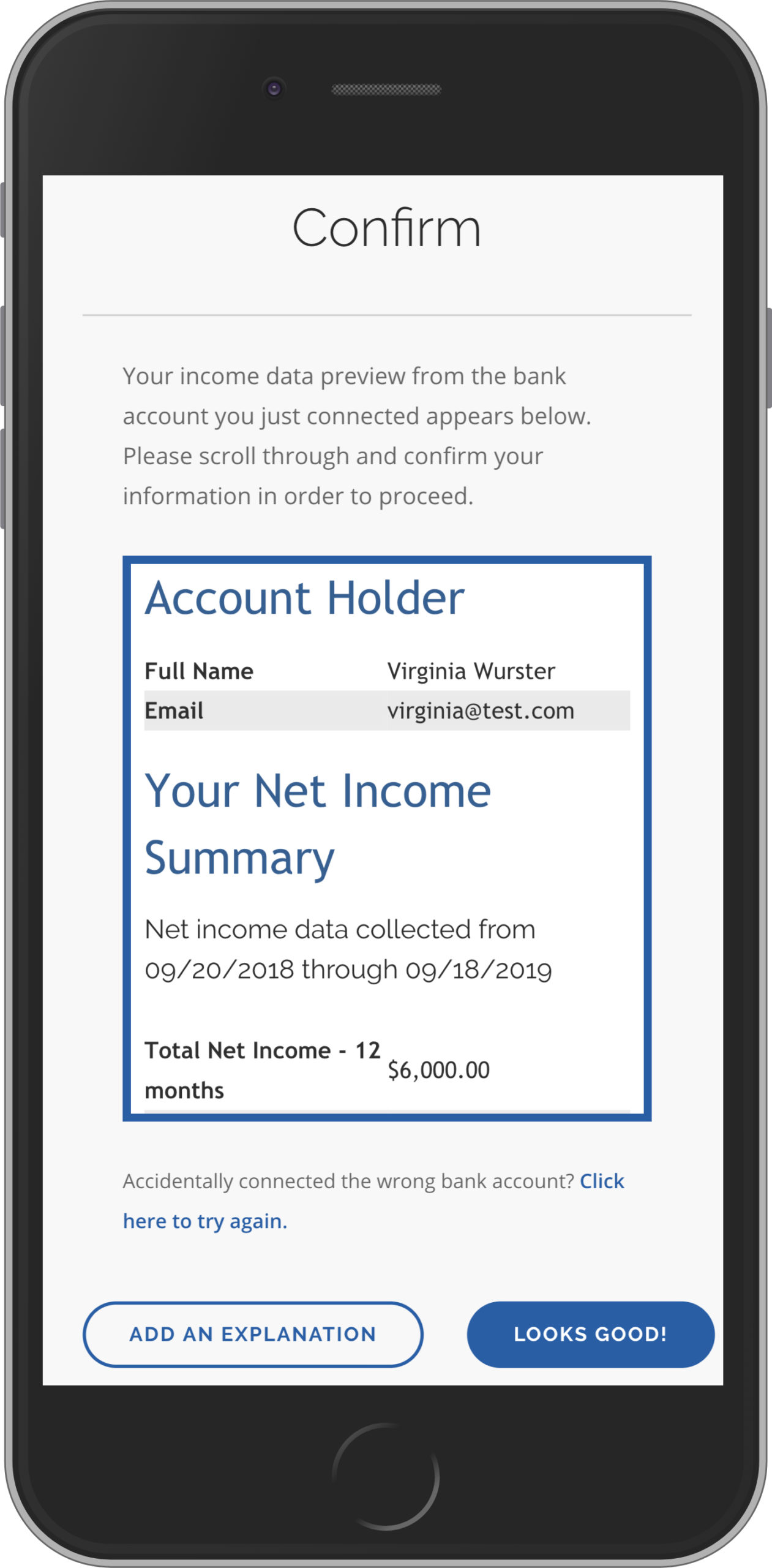

2. Confirm

You’ll then verify that the info in the generated income report is accurate. If an explanation feels necessary, there is an opportunity to write in a note to support the report.

If the report looks right, and the explanation is done, hit “Looks Good!”

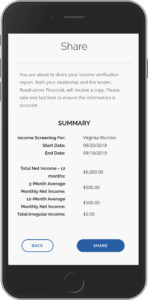

3. Share

One last screen will prompt you to confirm that all information is right, and then the income report is finally shared with Roadrunner Financial.

Ready to use this awesome feature, dealers? Sign up!

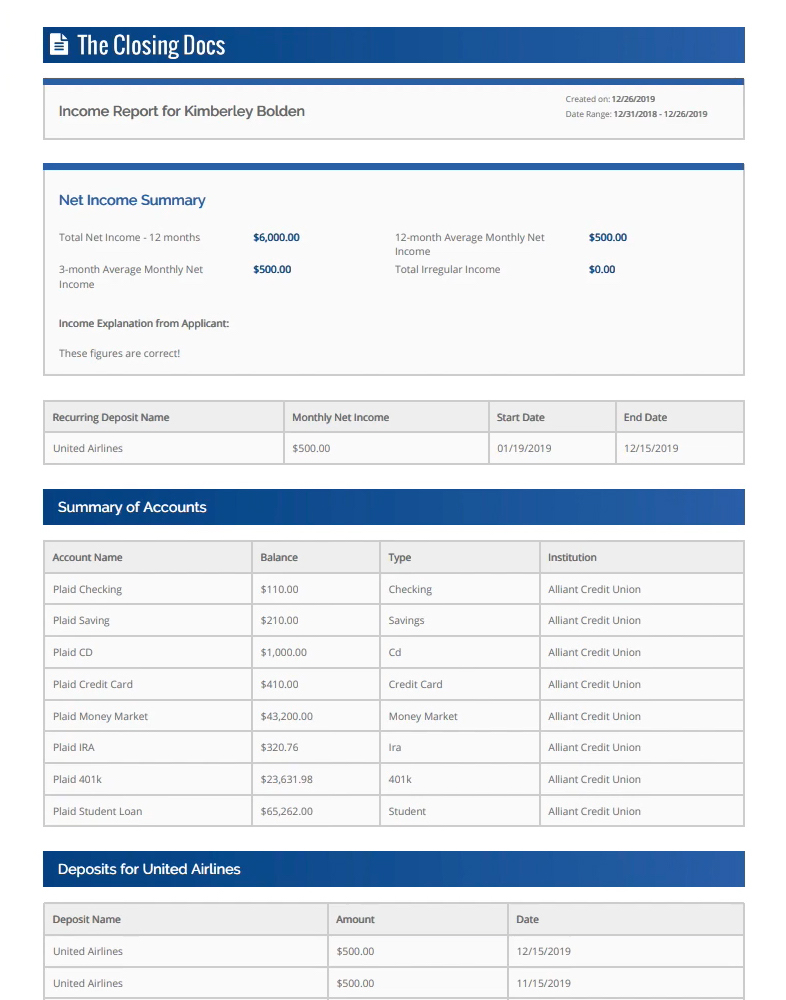

Roadrunner: Review

Roadrunner Financial loan processors will review the income report within minutes of receiving it. The report that Roadrunner Financial sees is identical to the version that the customer saw, and contains the explanation (if one was written).

The Proof of Income Report contains income estimates, a summary of accounts, and any recurring deposits. The recurring deposits section is the most important section of the report.

While loan processors will look at the estimates at the top, the recurring deposits are used to calculate a separate figure that they will also use. The Instant Proof of Income Report is reviewed with the same rigor as a bank statement.

Once reviewed, loan processors will enter the income verification into the Octane platform.

The dealer checklist is updated. Dealers are also able to view a copy of the Proof of Income Report.

Income is now verified – no hoops to jump through and no time wasted! Utilizing the Instant Proof of Income Report, on top of Roadrunner Financial’s instant decisions, is the way to get closing faster than ever before.

Ready to use this awesome feature, dealers? Sign up!

The above article is being provided for informational purposes only and shall not be considered any type of professional advice. Roadrunner Financial, Inc. (RF) does not warrant the accuracy of the information contained herein. Prior to utilizing RF as a lender, all dealerships are subject to underwriting approval by RF, in its sole discretion. No loans will be funded without a signed Dealer Agreement between the dealership and RF. All applicants for credit through RF are subject to credit approval. Other qualifications and restrictions may apply.